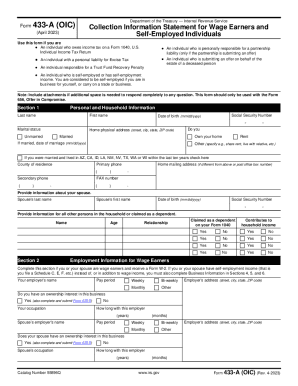

Who needs an IRS Form 433-A (OIC)?

Collection Information Statement for Wage Earners and Self-Employed Individuals (Form 433-A) is required by the IRS to evaluate how a wage earner or self-employed individual can satisfy an outstanding tax liability.

The tax form 433-A is to be used by individuals who:

- owe income tax on a Form 1040, U.S. Individual Income Tax Return;

- have personal liability for Excise Tax;

- are responsible for a Trust Fund Recovery Penalty;

- are personally responsible for a partnership liability;

- are self-employed or have self-employment income.

What is IRS 433-A (OIC) form for?

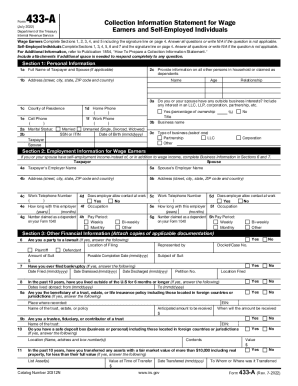

This form provides personal and household information of the submitter including employment information for wage earners (if such), personal asset information, business asset information (for self-employed), and income and expense information for both wage earners and the self-employed.

All of this information will be used by the IRS to evaluate whether a tax debtor is subject to payment plan or temporary delay.

Is IRS Form 433-A accompanied by other forms?

Depending on your case, may require additional documents to be filed with 433-A form:

- Copies of a pay stub, earning statement, etc. from each employer;

- Copies of the most recent statement for each investment and retirement account;

- Copies of the most recent statements from all other source of income;

- Copies of the most recent statement from lender(s) on loans.

If your interests are represented by an attorney, you should attach Form 2848. Any of special circumstances on the case should be reported with Form 656.

When is IRS Form 433-A due?

The form must be supplied when it becomes necessary. Time for submission is not tied to any deadlines.

How do I fill out IRS Form 433-A?

You should provide information on topics listed below. Wage earners must fill out Sections 1, 2, 3, 7, 8, 9 and signature line in Section 10.

Self-employed individuals should complete Sections 4,5,6, in addition to Sections 1,2 (if applicable), 3, 7, 8, 9 and the signature line in Section 10.

Where do I send IRS Form 433-A?

Completed and signed, this form should be directed to the IRS office serving your business.