Understanding the Form 433-A OIC Rev Form: A Comprehensive Guide

Overview of form 433-a oic

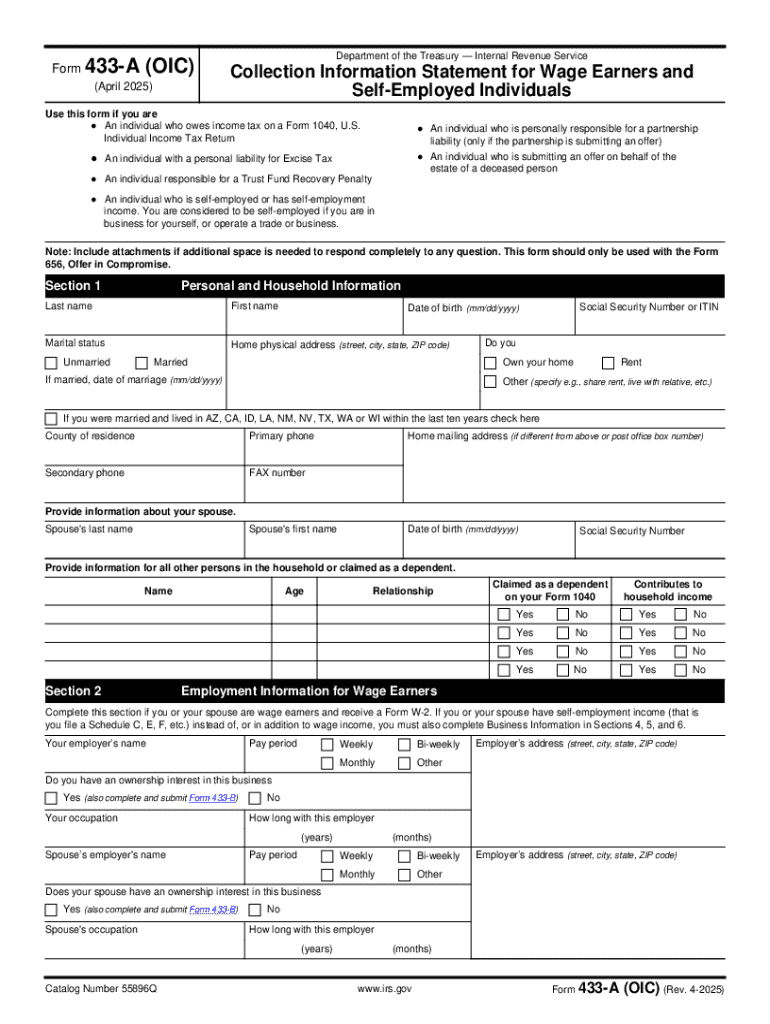

Form 433-A OIC, an integral element of the IRS Offer in Compromise (OIC) process, is essential for individuals and businesses seeking to settle their tax liabilities for less than the total amount owed. This form documents the taxpayer's financial situation, including assets, liabilities, income, and expenses, providing the IRS with the necessary information to assess an offer.

Revising the OIC is crucial as it reflects any changes in the taxpayer's financial circumstances, ensuring that the IRS has the most current and accurate information. This could significantly impact the outcome of the compromise negotiations.

Individuals: Taxpayers who owe money to the IRS and are looking to negotiate a lesser tax obligation.

Business Entities: Companies facing financial distress that seek to settle their tax debts through an OIC.

The key benefits of submitting the Form 433-A OIC include potential savings on tax liabilities, reduced financial stress, and the opportunity to resolve tax debts more quickly.

Understanding form 433-a oic

Form 433-A includes several components that collect vital information. The first section is personal information, such as the taxpayer's name, Social Security number, and contact details, which establishes the identification of the individual or entity involved.

The following sections detail assets and liabilities, requiring the taxpayer to list all valuable items, such as real estate, vehicles, and bank accounts, while simultaneously disclosing outstanding debts. The income and expense components are critical for determining the taxpayer's ability to pay, requiring careful documentation of monthly income streams and necessary living expenses.

Revisions made in the updated version of Form 433-A OIC enhance clarity and add details to each component for effective reporting. Many individuals mistakenly believe that lacking certain financial details won't hurt their case, but omitting or misreporting such information can lead to significant delays or rejections.

Detailed instructions on filling out form 433-a oic

Filling out Form 433-A involves several specific steps. First, taxpayers should complete the personal information section accurately. Incorrect or incomplete details here can lead to processing delays.

Next, taxpayers must carefully list all assets and their corresponding values. Each asset should be documented with supporting evidence. When reporting income, it is essential to be thorough; incomplete income details can skew the IRS's understanding of the taxpayer's financial situation.

Personal Information Entry: Include your full name, Social Security number, and any other required identification.

Listing Assets and Liabilities: Use precise valuations for each asset and be honest about outstanding liabilities.

Reporting Income and Monthly Expenses: Itemize all sources of income and categorize necessary monthly expenses.

To ensure accuracy, documenting assets with recent valuations or appraisals is advisable. When estimating monthly expenses, consider all household needs to provide a realistic picture.

Common errors include omitting important information and undervaluing or overvaluing assets. Such mistakes can significantly impact the outcome of the OIC negotiation.

Filing IRS form 433-a oic

Submitting the Form 433-A OIC can be done in two primary methods. Taxpayers can file online through the IRS portal, which offers a more streamlined and immediate submission process.

Alternatively, mailing the form is possible; however, it may result in longer processing times. Ensure that all required sections are filled out completely and attached with any necessary documentation before mailing.

Online Submission through IRS Portal: Offers instant acknowledgment of receipt and can speed up the processing timeline.

Mailing Instructions: Double-check addresses and use certified mail to track the submission.

Deadlines for submission vary depending on the taxpayer's situation. After submission, the IRS conducts a review to verify the information before responding, which can influence the next steps.

Interactive tools and resources for form 433-a oic

Using tools like pdfFiller can enhance the experience of managing Form 433-A OIC. A PDF editor allows users to customize the document, ensuring that all sections are appropriately filled and formatted.

Features such as eSigning enable quick submission, bypassing delays typically associated with traditional signing methods. Collaborative tools also allow team members or advisors to participate in the completion of the form.

PDF Editor Guide for Customization: Ensures the form is filled out correctly and meets IRS standards.

eSigning Features for Quick Submission: Facilitates immediate filing after completion.

Collaborative Tools for Team Involvement: Allows multiple stakeholders to contribute to filling out the form efficiently.

A frequently asked questions section can provide additional clarity, addressing common concerns such as how to track submission status or what to do if changes are needed after filing.

Real-life scenarios: success stories and challenges

Several case studies illustrate how successful negotiation with the IRS can be achieved using Form 433-A OIC. Taxpayers who thoroughly prepared their financial information often experienced reduced tax liabilities.

Conversely, challenges often include missed deadlines and incomplete forms. Understanding these potential pitfalls can help users prepare effectively, ensuring all necessary documentation is included.

Support and consultation options

Those seeking help when filling out Form 433-A OIC can find numerous resources, including live support through pdfFiller and access to professional tax consultants. Engaging these experts can provide tailored advice and assist in navigating the complexities of the OIC process.

Legal considerations are also important; working with a tax attorney can help clarify any legal implications of the offer. Knowing when to seek professional help ensures that the taxpayer's rights are protected while pursuing the OIC.

pdfFiller Live Support: Immediate assistance for technical and procedural queries.

Professional Tax Consultant Resources: Access to experts who understand the IRS procedures.

Final thoughts on navigating form 433-a oic

Navigating Form 433-A OIC can be intimidating, but with the right tools and understanding, it becomes a manageable process. Taxpayers are encouraged to take charge of their financial situations by preparing their documents accurately and efficiently.

Utilizing services like pdfFiller empowers users to handle their document needs seamlessly, ensuring they are well-equipped to present their case to the IRS. This proactive approach can lead to meaningful resolutions of tax debts.